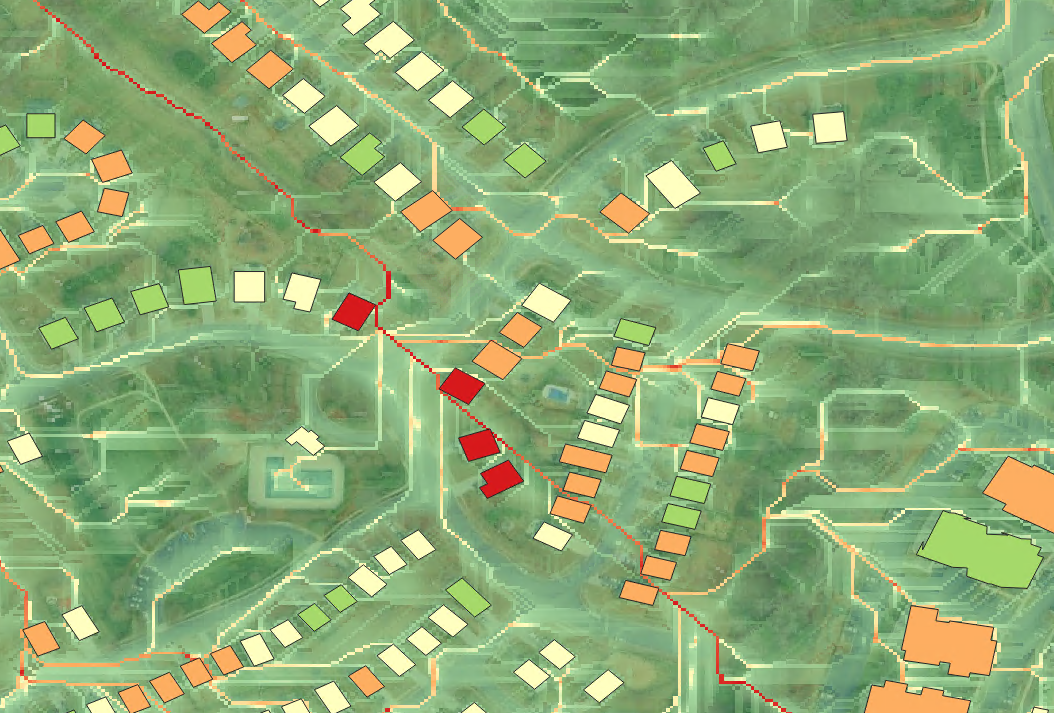

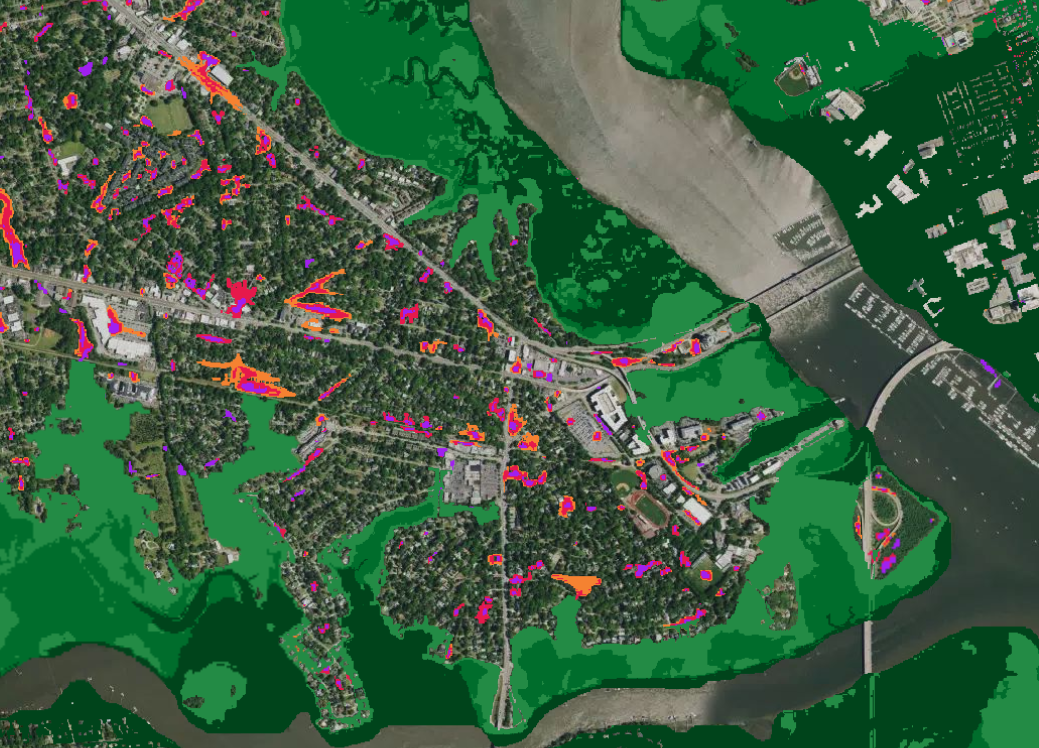

1×1 meter accuracy ensuring reliable local risk identification

What is different about our approach?

Resolution

Input data update

Always updated with new terrain, land-use, and infrastructure data

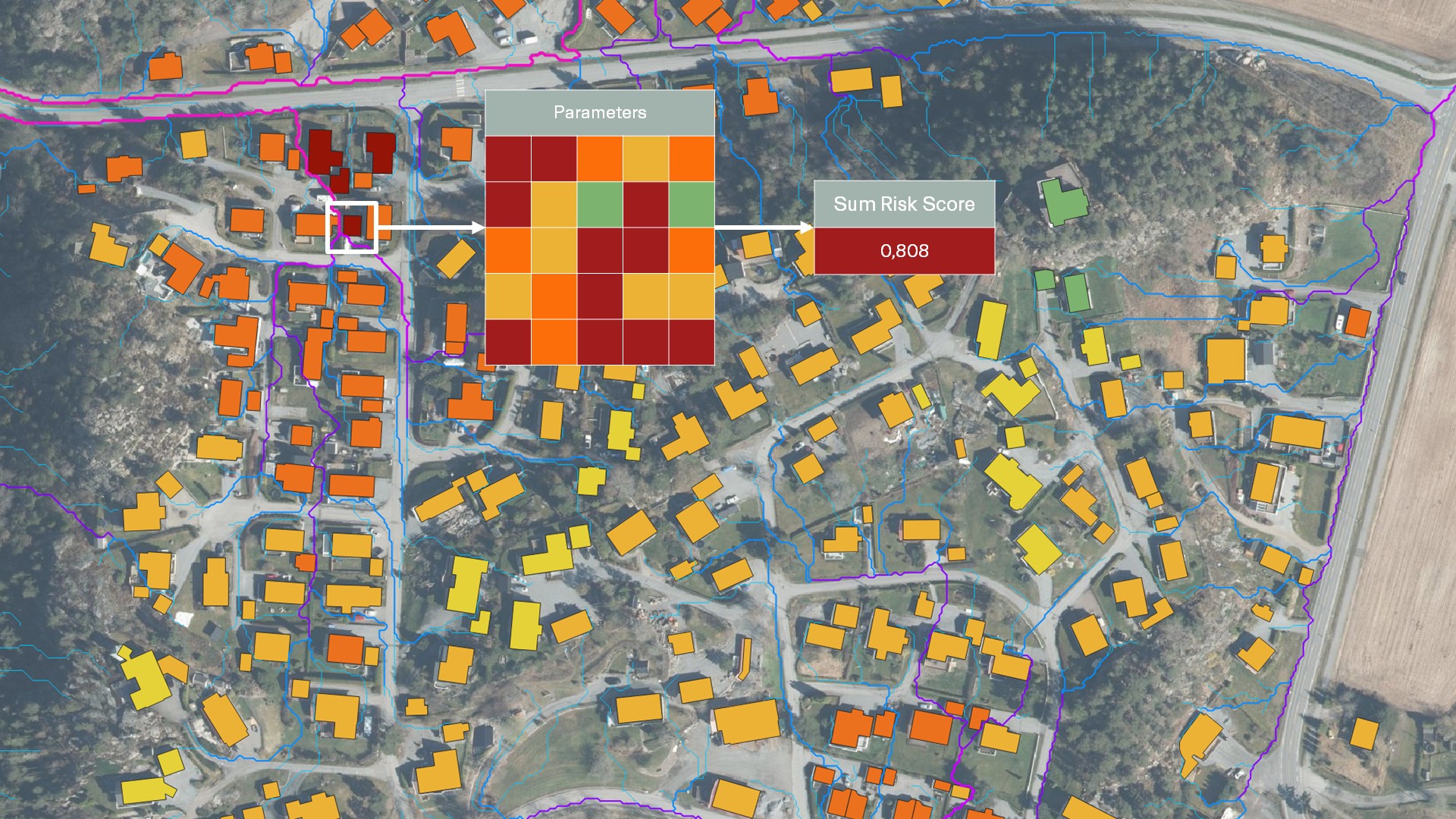

Claims training

Designed for easy integration into existing workflows

Know your locations

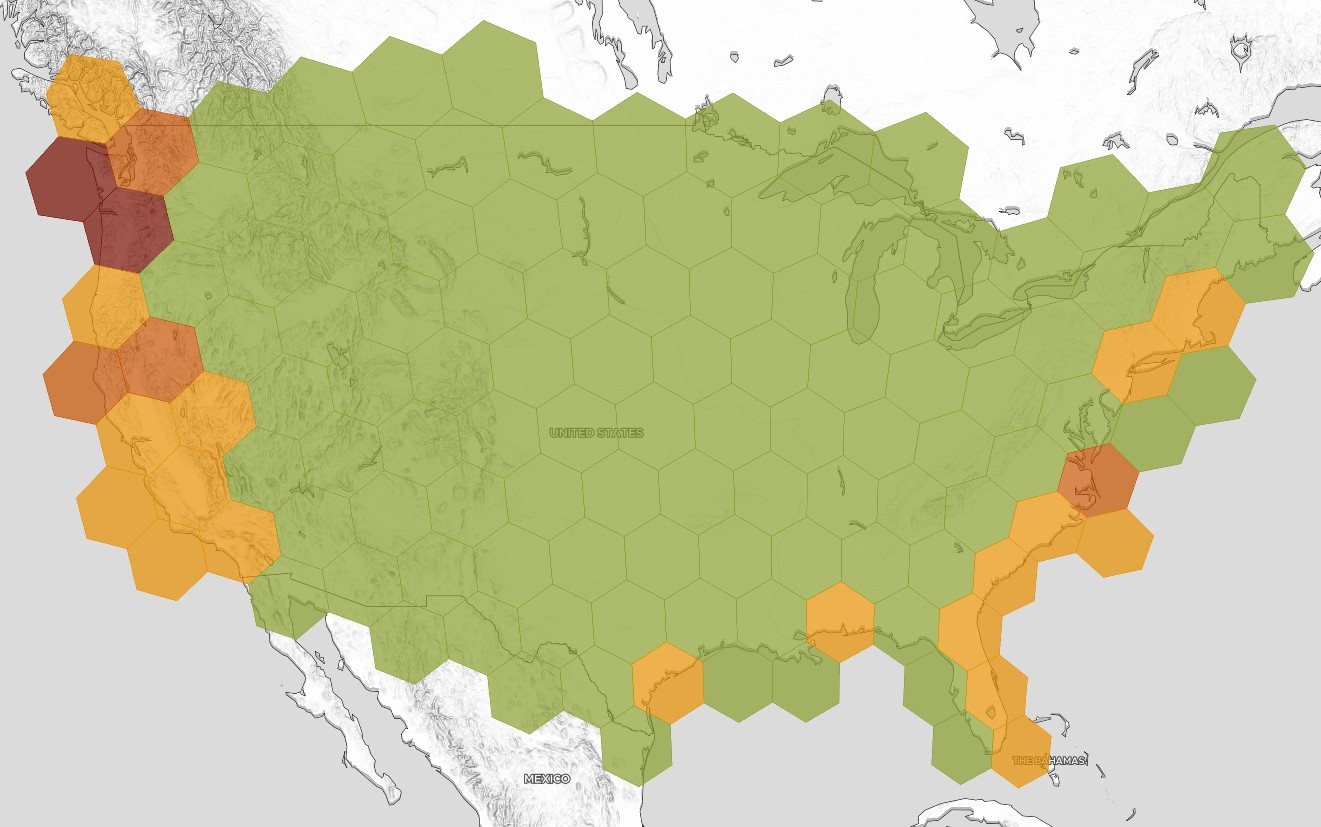

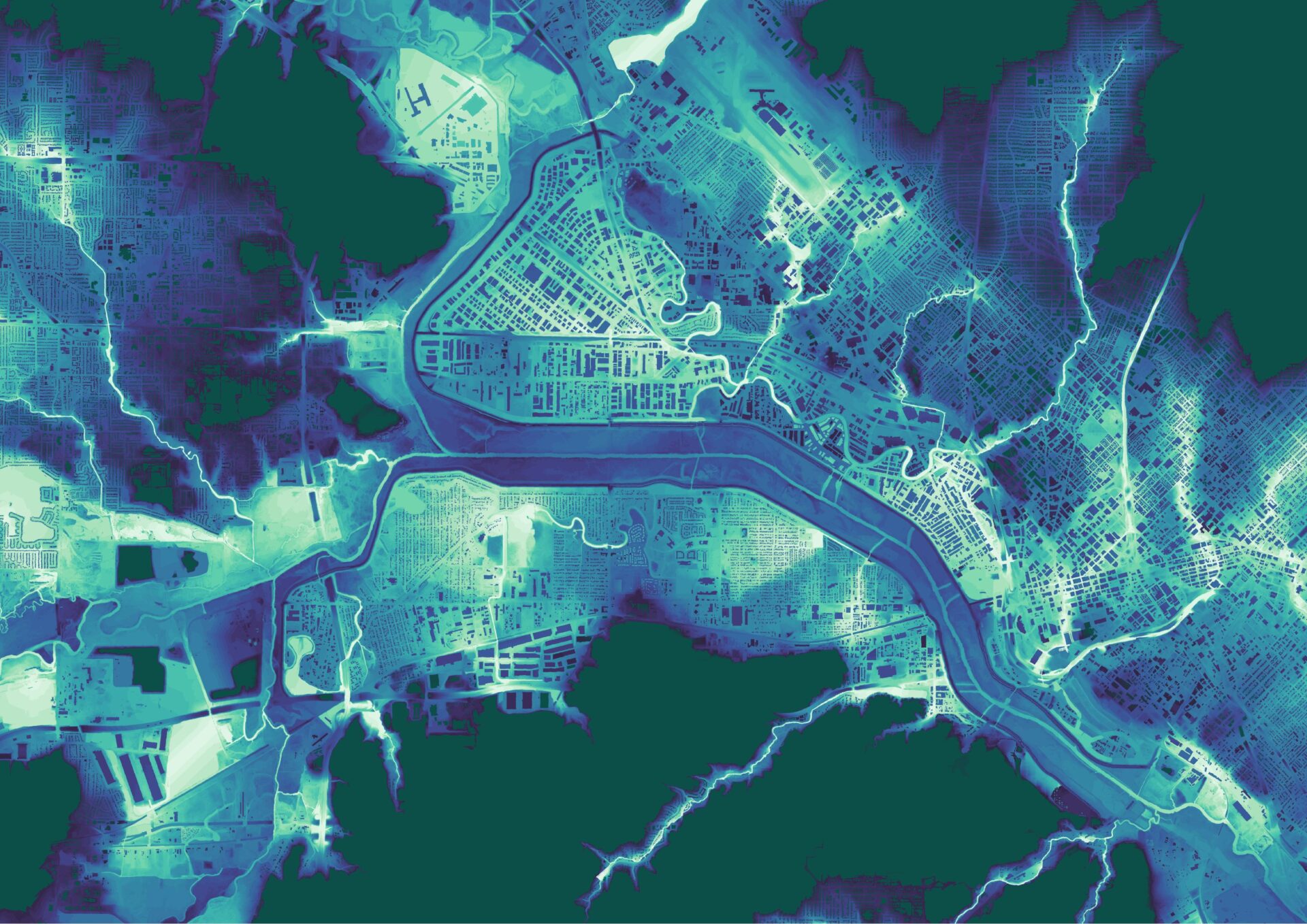

Our Hazard Maps set a new benchmark for understanding and managing flood exposure.

Developed by 7Analytics’ team of hydrologists, geologists, and data scientists, they provide a precise, up-to-date view of how water interacts with the landscape—helping insurers, banks, and asset owners make confident, data-driven decisions.

7Analytics power your smart flood risk work with a unique Hazard Map:

- Traditional hazard maps rely heavily on static input data, which means they struggle to capture how today’s built environment and climate dynamics influence risk. 7Analytics takes a much more granular approach.

- With 1×1 meter resolution, our Hazard Maps identify micro-level variations—such as curbs, embankments, or drainage infrastructure—that can make the difference between minor surface water accumulation and significant flood damage. Updated continuously with the latest digital elevation and infrastructure data, the maps stay accurate even as urban landscapes evolve.

The result is an evolving, updated view of physical risk. Whether used for underwriting, exposure management, credit assessment, or infrastructure planning, our Hazard Maps provide the transparency and precision needed to quantify and mitigate risk effectively.

By integrating our maps into your workflow, you gain actionable insight—not just where flooding has occurred before, but where it will likely occur next.