Earlier this autumn, we hosted a workshop with a strong team from Landkreditt Bank to explore how flood risk data can strengthen credit processes and decision-making. From the Head of Credit Risk to Sustainability Leads, the group brought valuable perspectives and great energy to the discussions.

The timing couldn’t be more relevant. The European Central Bank recently highlighted that banks are beginning to apply a physical climate risk premium on mortgages in high-risk areas, a trend that has accelerated following new supervisory expectations.

Why? Because climate risk affects both collateral values and borrowers’ ability to repay.

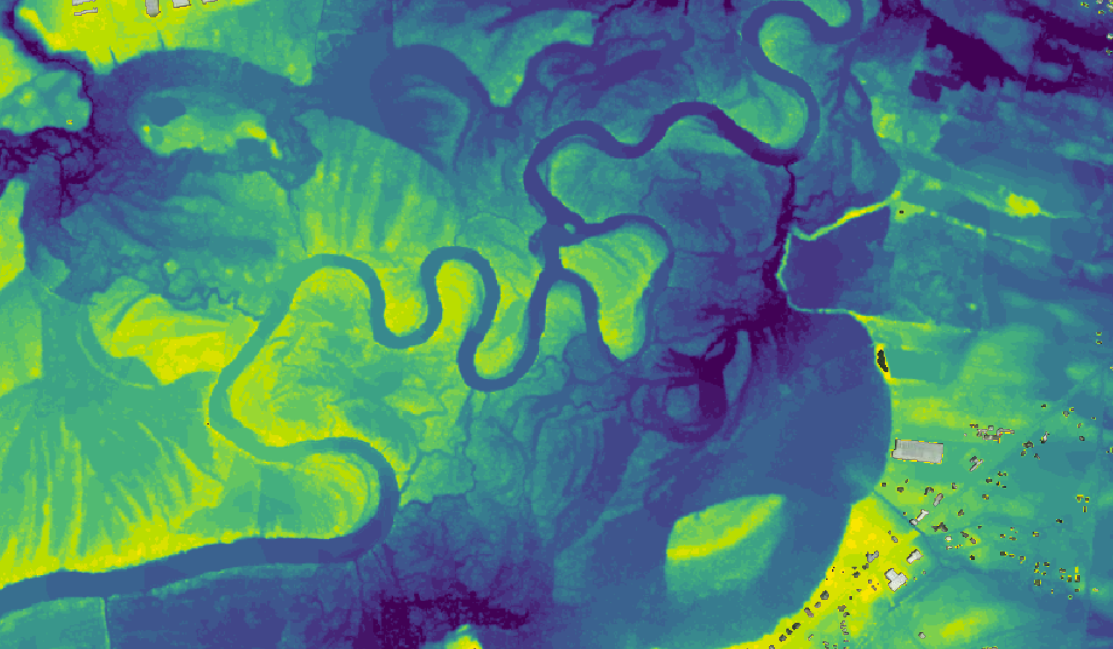

Landkreditt’s interest in flood risk is also tied to their advisory role within the Norwegian agricultural sector. Access to granular, forward-looking data is therefore becoming increasingly essential.

After a thorough evaluation of similar data providers in the market last autumn, Landkreditt chose to partner with 7Analytics, finding our flood risk data to be the most accurate and reliable available.

“We tested 7Analytics’ risk score against historical claims data at Landkreditt. The analysis was run on houses insured by Landkreditt over the past five years. The results clearly show that the higher the flood risk score, the more claims payments we have historically made,”

says Christer Flakke, Director Data and Insights at Landkreditt.

We are proud to support Landkreditt on their journey to remain leaders in climate-resilient banking.

Jonas Aas Torland

CCO & Co-Founder