New research highlights a critical blind spot for banks and mortgage lenders: pluvial flood risk.

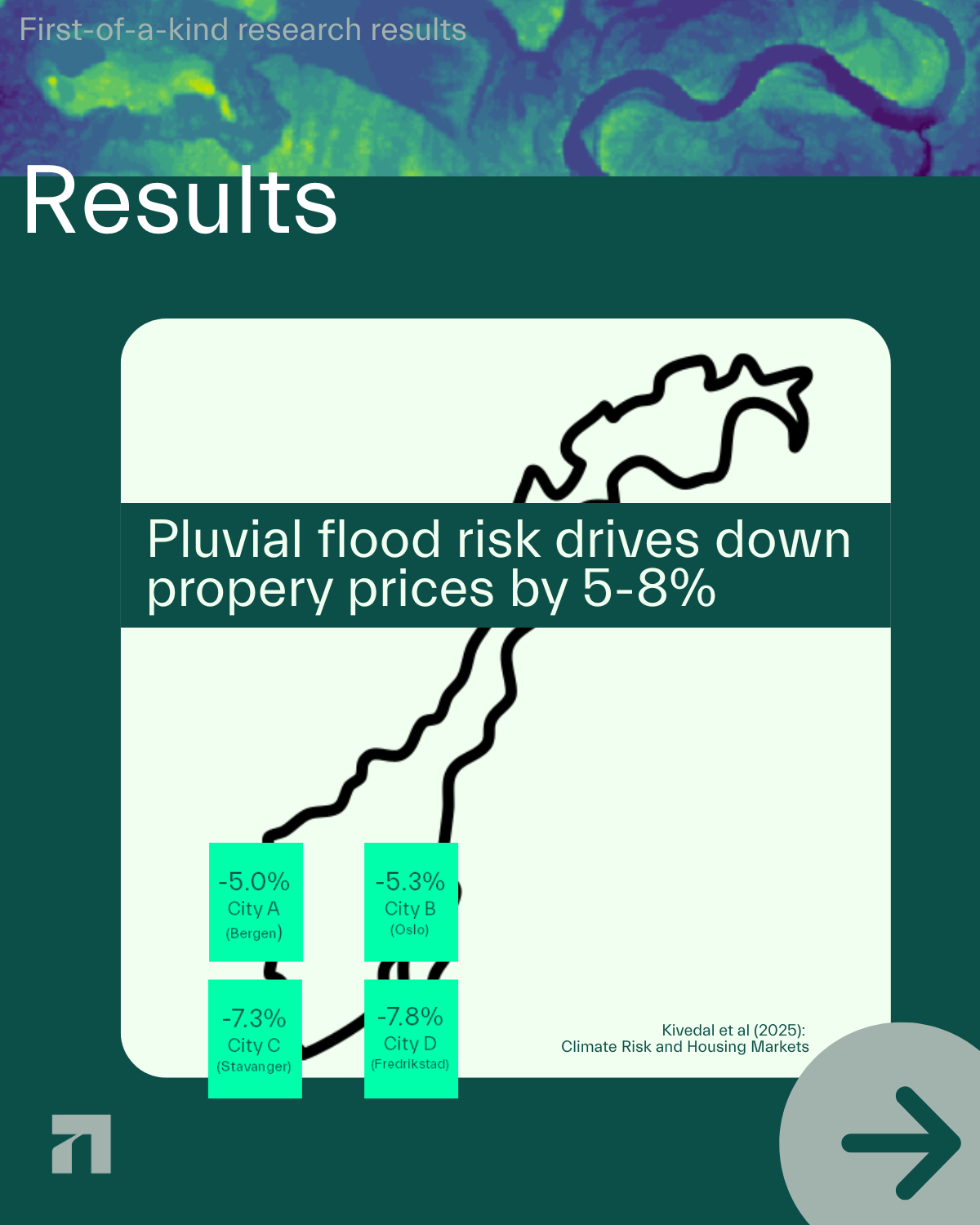

The study, using nearly 200,000 housing transactions across five Norwegian cities, finds that climate risk — especially pluvial flood risk — significantly depresses house prices once buyers account for expected damage. This price discount reflects a growing recognition that traditional property valuations may fail to price in future extreme rainfall risk, even as such events become more frequent with climate change.

The study by Professor Bjørnar Karlsen Kivedal is co-authored by our colleagues Werner Svellingen and Geir Torgersen and applies 7Analytics’ flood risk data as basis for the analysis.

Why pluvial flood risk

• Unlike river (fluvial) or coastal flooding, pluvial floods result from intense rainfall overwhelming drainage capacity, are influenced by local topography and urban land use, and are often not captured in flood risk assessments used by lenders and insurers.

• River and coastal flood are easier to capture whereas pluvial flood is more demanding on input data and often occurs in areas that never flooded before.

Why this matters for banks and mortgage providers

• Mortgage collateral is only as solid as the underlying property value. If flood risk is unknown or under-priced, loan-to-value ratios may be overstated.

• Pluvial flood exposure is spatially nuanced and often excluded from standard risk models — a blind spot that could translate into unexpected credit and portfolio risk.

• Rising pluvial exposure means that risk of negative equity and higher default probabilities could emerge long before lenders realize.

What sets this work apart

• Most existing literature and risk models focus on fluvial or coastal flooding, but this paper empirically demonstrates that pluvial flood risk matters for property prices and financial stability, too — precisely because it is more frequent, harder to observe, and less integrated into existing credit risk frameworks.

• For banks and mortgage providers aiming to future-proof portfolios, incorporating pluvial flood risk indicators — not just traditional flood maps — into credit assessment and stress testing is becoming mission-critical.

Kivedal, BK; Svellingen, W, & Torgersen, G (2025): “Climate risks and housing markets”, Housing Lab Working Paper Series