Parametric flood insurance is a type of insurance that pays out automatically when a predefined event or measurement occurs — rather than reimbursing the actual cost of damages after an assessment.

Traditional flood policies can be simplified as

Flood event + insurance policy + claims filing + adjuster visit = payout

In comparison, a parametric flood insurance can have this stylized form:

Flood event + insurance policy + automatic flood tricker evaluation = payout

Instead of sending an adjuster to inspect flood damage, a parametric policy pays a fixed amount once certain objective flood conditions are met — for example, if a nearby river rises above a set level or rainfall exceeds a specific threshold.

While the solution has potentials and challenges, it remains a minor product line within insurance. That might change as demands change, as products innovation continues, and as risk data improves.

What are trickers in parametric flood insurance?

Parametric flood insurance pays out based on predefined triggers rather than actual loss assessments. These triggers aim to be objective, measurable, and set in advance. Common payout triggers for parametric flood insurance include:

1. Water level thresholds – Payouts are triggered when floodwaters exceed a predefined depth at a specific location, such as a river gauge or sensor or storm surge height.

2. Rainfall accumulation – If rainfall exceeds a set threshold within a given time frame (e.g., 200mm in 24 hours), the policy activates.

3. Modelled flood inundation – Payments are based on flood models that predict inundation depth and extent based on real-time data.

4. Satellite data – Some policies use remote sensing data to determine flood coverage and intensity.

5. Government or agency declarations – Some parametric policies use official disaster declarations from agencies like FEMA or local governments.

Since these policies do not require traditional claims adjusting, they provide rapid payouts, making them attractive in disaster relief and business continuity planning where timing of cash flows might be particularly crucial.

Which trigger is most common?

One widely adopted payout trigger for parametric flood insurance is water level thresholds. This trigger is typically based on the water depth at a specific gauge, such as a river or coastal monitoring station. When the water level exceeds a predefined threshold (e.g., a certain number of feet or meters above normal), the payout is automatically triggered.

Water level thresholds are widely used because they are objective, measurable, and relatively easy to monitor using existing infrastructure like flood gauges, making them a straightforward and reliable trigger for insurers and policyholders alike.

However, it also has its limitations as the policyholder will typically be located at some distance from the measurement point. There is a likely discrepancy between tricker, risk and actual damage which relates to the concept of ‘basis risk’.

Key issue parametric insurance: Basis risk

While parametric insurance has many benefits, it comes with basis risk — the risk that a payout does not perfectly match the policyholder’s actual loss. For example, a business might flood but not get paid if the water level trigger wasn’t met, or vice versa.

Again, in parametric insurance, this happens because payouts depend on measurable triggers (like rainfall or flood depth) rather than on verified damages (damaged inventory worth assessed amount of dollars).

So, two main scenarios can occur:

· False negative (underpayment): The policyholder suffers losses, but the trigger isn’t met, so no payout occurs. This could be in the case of flooded town due to local drainage failure, but the nearest river gauge does not exceed the trigger level.

· False positive (overpayment): The trigger is met, but the policyholder experiences little or no loss. Here, an example could be an upstream gauge that exceeds the water level trigger, but the insured site stays dry due to levees or topography.

For individuals or small businesses, it might make the parametric product feel unfair or unreliable if a visible flood does not lead to a payout.

In many ways precision is traded for speed and certainty, but a balance has to be maintained as pricing, credibility, and adoption are influenced — too much basis risk undermines trust.

The underlying flood risk data is fundamental for striking the right balance. Data quality directly determines how much basis risk exists as poor data produces unreliable triggers and risks of higher mismatch between payout and real losses and inefficient products.

What is the role of flood modelling in parametric flood insurance?

Advancements in flood modelling are one of the driving forces of enhanced data quality underlying parametric flood insurance solutions. Similarly, progress in remote-sensing via satellites improve the accuracy of measurements.

Flood modelling is not a direct measurement and has to be accurate to reduce basis risk but it offers a list of upsides by being able to:

– Look days ahead (not just during or post-event);

– Capture short-lived flood peaks (not rely on timing of satellites passing);

– Integrate multiple data sources (sensors, rain forecasts, satellite images);

– Provide asset-specific estimates (as opposed to distant measurement points);

– Independent of location sensors (while a strong data source, site-specific sensors is also a fragile one)

– Work even with dense cloud covers (where some remote-sensing technologies fail to record floods); and

– Estimate both flood extend and depth which in combination drive losses.

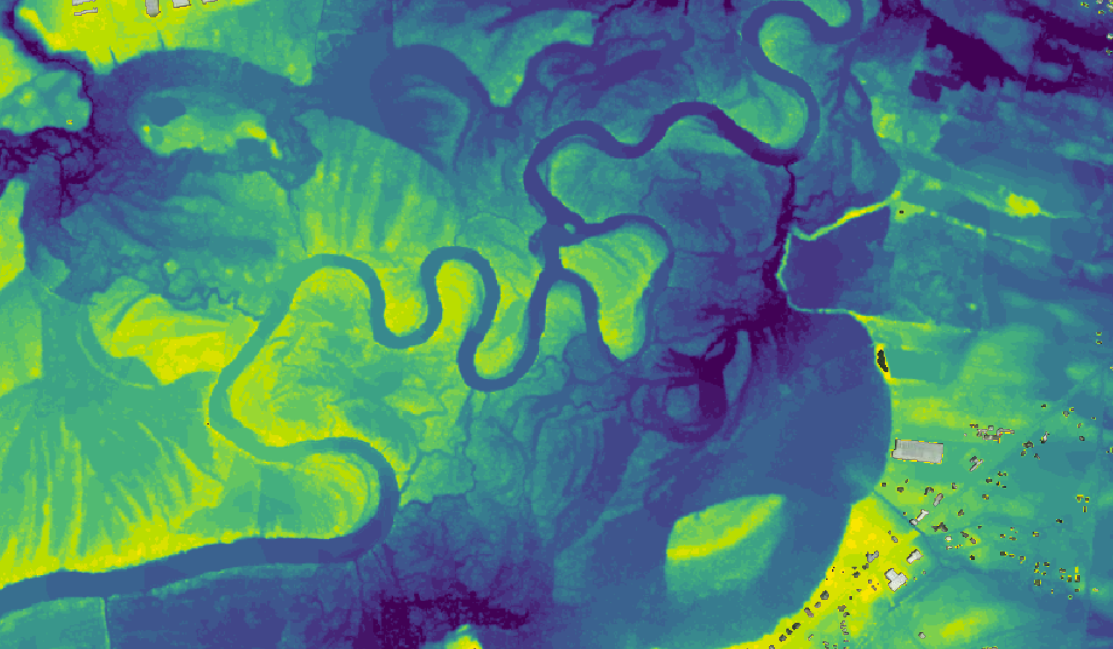

For 7Analytics, as a flood modeler, ultra-high resolution geo data lies at the core of everything we do which helps our parametric insurance partners lower basis risk. One aspect of this is that we model flood hazard at 1 x 1m resolution, which as far as we know is the most granular available. To illustrate why that is important, we here compare 1 x 1m resolution with 10 x 10m granularity. For 1m resolution, the associated vertical uncertainty is around 20cm, while at 10m resolution it balloons to more than 2m.

As flood depths at various precipitation levels function as a key input in estimating property damage, it goes without saying that 1m resolution provides a significant advantage in loss modelling.

The combination of our approach and data granularity is particularly well-suited to assess and monitor flood risk in urban areas, which is both the biggest current knowledge gap and fastest growing cause of loss. We see time and again that there can be huge shifts in the risk between two properties just across the street from each other. In such cases, coarse models struggle to differentiate.

Who offers parametric flood insurance in the US?

Several insurers are marketing products and it seems to be a fast-growing segment. Examples include:

-

Descartes Underwriting: Parametric products linked to on-site sensors, river gauge levels, or gridded rainfall data. See detail.

-

Yokahu: Offers parametric flood insurance on its innovative cat-risk.com platform. See details.

-

Burns & Wilcox: Focusing on commercial risk using on-site sensors. See details.

-

Liberty Mutual Insurance: Links product to both site-specific (satellite and sensors) and remote triggers (river gauges and accumulated rainfall). See details.

7Analytics’s parametric flood data offering

To enhance the relevance and precision of parametric flood solutions, it is crucial to account for the physical context in which rainfall occurs. This includes factors such as terrain elevation, soil saturation levels, drainage infrastructure capacity, building positioning, and land use. These elements often serve as more reliable predictors of damage than rainfall alone and should form the core of future trigger development. For instance, a house in a desert catchment with compacted, dry soil might face a similar flood risk under intense rain as a house in a coastal city—albeit for entirely different underlying reasons.

Addressing these complexities, 7Analytics is at the forefront of parametric insurance, innovating in both policy pricing and trigger setting for urban pluvial flooding. Unlike traditional hazard-work, our parametric pricing model for a building directly assesses its inherent flood hazard, moving beyond reliance on historical damage. This is achieved through a proprietary flood risk machine learning model that assigns a detailed urban pluvial flood risk score to every building. This sophisticated model integrates high-resolution geospatial data, actual insurance claims, and millions of diverse data points, analyzing hundreds of parameters to identify the most critical risk factors. As a result, insurers can leverage this building-specific risk score for highly accurate and granular policy pricing. Furthermore, 7Analytics ensures rapid and precise trigger activation, a critical aspect for both policyholders and insurers. By utilizing the same advanced technology that powers their early-warning flood solution, they can provide detailed post-event analysis at an exceptional 1x1m/3x3ft resolution, delivering accurate information on water extent and depth.

Our model simulates the rainfall event intelligently accounting for ground infiltration and operating on a high-resolution terrain model that incorporates intricate water flow patterns. This capability empowers insurers to accurately evaluate the actual impact of rainfall events on individual properties and determine precise water levels, facilitating efficient and transparent claims payouts. Ultimately, in our view, the future of parametric flood insurance hinges on the ability to move beyond simplistic, weather-based triggers and embrace more sophisticated models that incorporate the intricate interplay of environmental and urban factors.

7Analytics’ innovative approach, which leverages advanced data analytics and high-resolution modeling for both risk pricing and trigger setting in urban pluvial flooding, represents a significant step in this crucial evolution. By focusing on inherent risk and actual impact, they offer a pathway towards more relevant, accurate, and ultimately more widely adopted parametric flood insurance solutions, paving the way for a more resilient future in the face of increasing flood risks.

Moving away from coarse zip-code pricing to risk-reflecting products is a key future avenue of parametric flood insurance which we see great potential in. Additionally, we have developed our models to integrate with weather forecasts, meaning we also provide an Early Warning System (EWS) in partnership with StormGeo predicting all types of flooding at the same level of site-specific granularity several days ahead. That we have based our risk database, hazard maps and forecasting system on the same underlying high-resolution framework is also an advantage.

Hurricane Mellissa (October 2025):

Was that a case of parametric flood insurance?

Hurricane Melissa devastated parts of the Caribbean (Jamaica, Haiti, Cuba) with very large rainfall, storm surge, and extreme winds. For example, rainfall totals of up to 1,000 mm (40 inches) were observed in some regions, with serious flood and landslide risk.

Melissa made landfall as a Category 5 storm in Jamaica (28 October 2025) which made a combination of insurance and catastrophe bonds pay out to help the country rebuild.

Excess rain and heavy wind

Jamaica has coverage from CCRIF SPC (formerly the Caribbean Catastrophe Risk Insurance Facility), The Caribbean and Central America Parametric Insurance Facility and Development Insurer, for tropical cyclone and excess rainfall.

The parametric insurance policies are based on modelled losses from wind and storm surge, and the excess rainfall policy is based on the volume and distribution of rainfall. Payouts totaled USD 91.9 M released within 14 days of the event which according to the facility gives “immediate access to liquidity to support vulnerable populations, repair critical infrastructure, stabilize public services such as water, and reduce the country’s economic exposure, safeguarding debt and fiscal sustainability targets and overall development gains”.

For excess rainfall, the trigger was evaluated with a calculated Rainfall Index Loss above the attachment point of the policy. However, two other triggers were not met, namely for Wet Season and Localized Events.

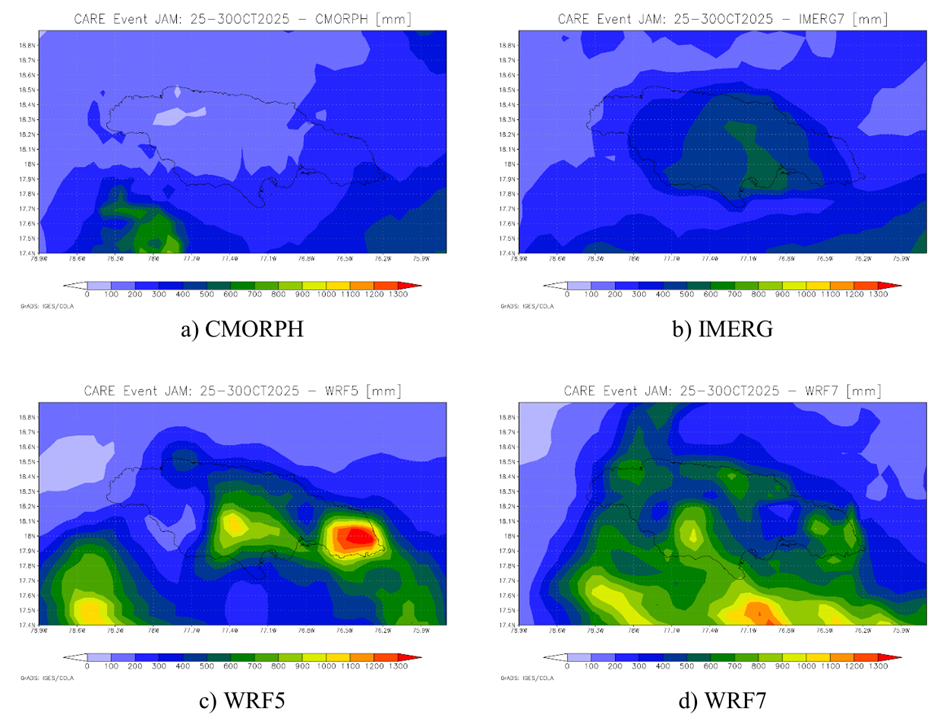

Illustrated below are four of the precipitation data sources feeding into the evaluation showing great variation of between 200 and 1,200 mm aggregate rainfall.

Storm location and pressure

In addition, the government of Jamaica had a parametric catastrophe bond triggered by certain storm parameters. While not a parametric flood insurance, the parametric catastrophe bond has many similarities with an insurance policy. The bond was arranged by the World Bank in 2024 and covers tropical cyclone risk for Jamaica.

Already on November 7, a full 100% payout of its USD 150 million parametric catastrophe bond was announced. This shows the speed of the payout mechanism linked to the parametric trigger. The bond’s trigger was based on storm location and minimum central pressure. With a central pressure of 892mb, the storm’s eye was well into the parametric boxes of Jamaica’s catastrophe bond. These funds are now funding the critical aftermath of Hurricane Mellissa helping the island’s population and institutions recover.

In summary: the benefits of parametric flood insurance

Parametric flood insurance has several distinct advantages over traditional indemnity-based flood insurance. Here is a benefits summary:

1. Faster and predictable payouts. Because payouts are triggered by an objective measurement, pre-defined funds can be disbursed within days — sometimes even hours — after the event. Benefit: This speed and certainty are critical for disaster recovery, allowing businesses, governments, and households to cover immediate needs like cleanup, temporary housing, and restarting operations. On the other hand, traditional insurance can take weeks or months due to loss assessment, documentation, and claims adjustment.

2. Reduced Claims Disputes. The payout is based on a clear, pre-agreed trigger, which eliminates lengthy disputes and litigation that can delay recovery.

3. Lower Administrative Costs. Without site visits or claims adjusting overheads for insurers and policyholders are reduced.

4. Coverage for intangible and indirect losses. Payouts can be used for any purpose — not just repairing physical damage covering business interruption, evacuation costs, or other indirect economic impacts that traditional insurance might not cover.

5. Accessibility for hard-to-insure areas. It has the potential to expands financial protection to communities (developing countries or flood plain residents) historically underserved by traditional insurers.

–> Despite these benefits, parametric flood insurance has very limited uptake. Climate change and traditional insurance withdrawing from certain geographies in combination with continued products innovation and improved risk data it might be a go-to solution of the future.