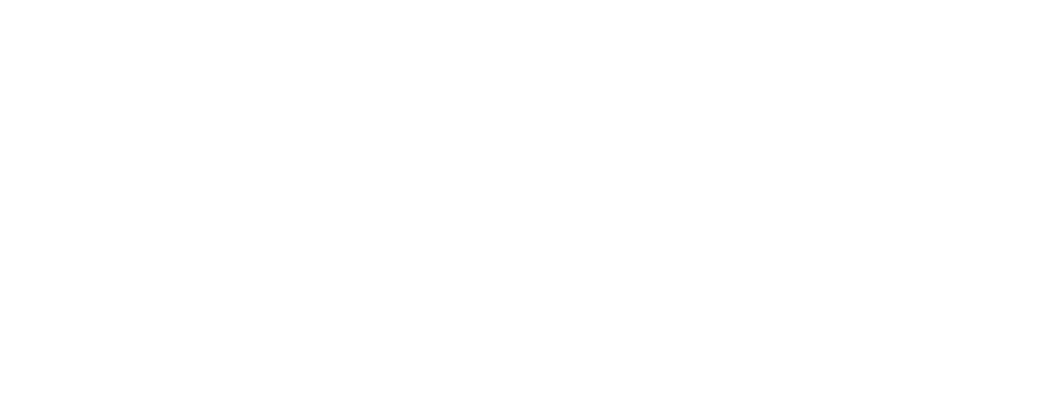

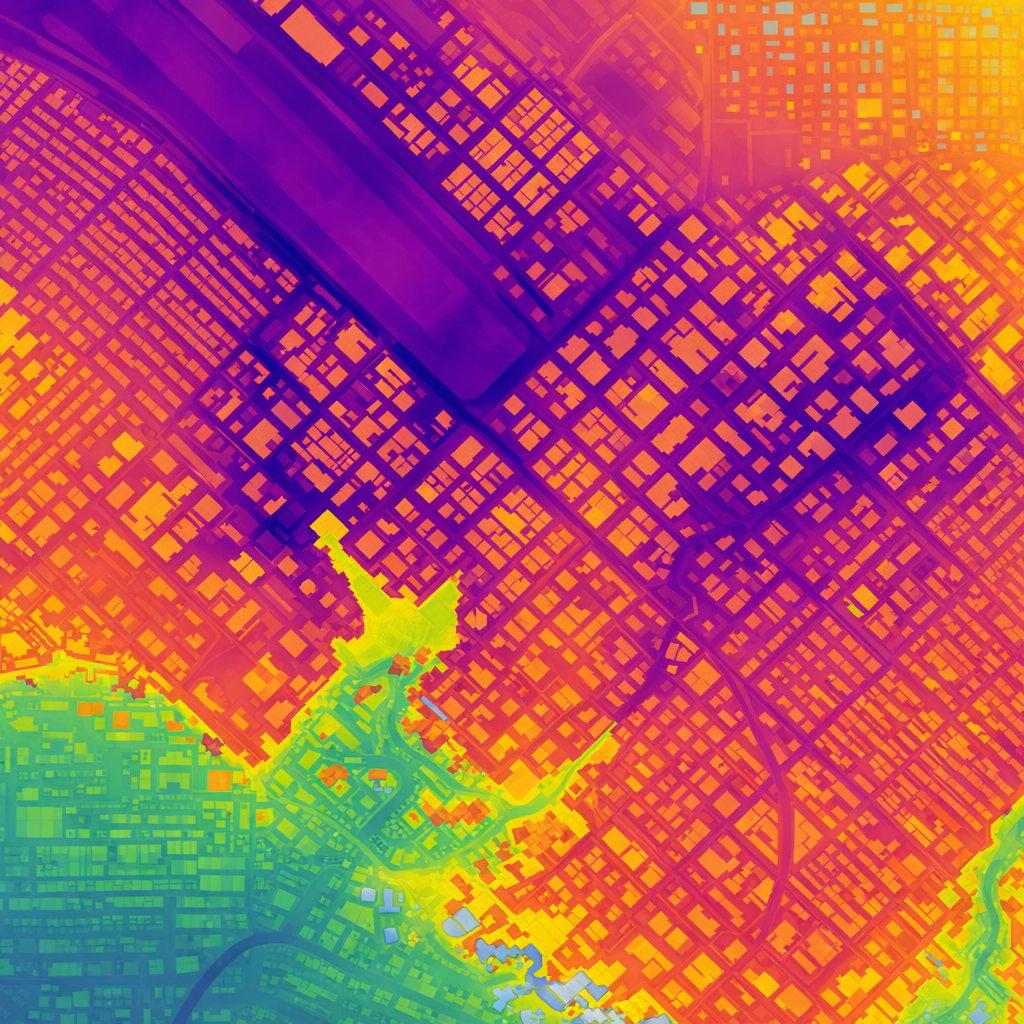

1 x 1 m geospatial resolution land-use cover and terrain data

What is different about our approach?

Resolution

Input data update

Continuous reprocessing of new data

Claims training

Trained and calibrated on verified insurance claims

Pluvial Flood Index

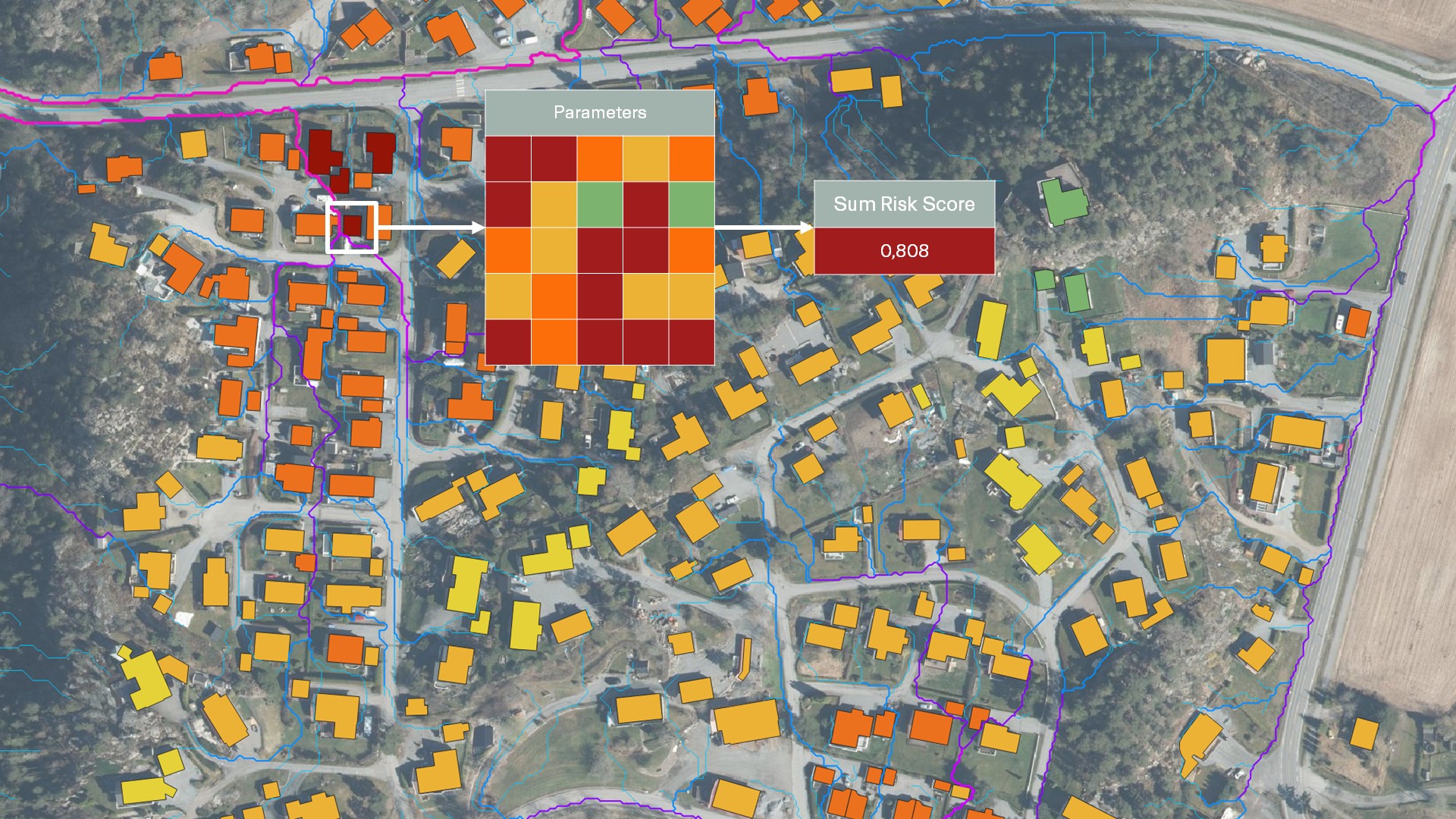

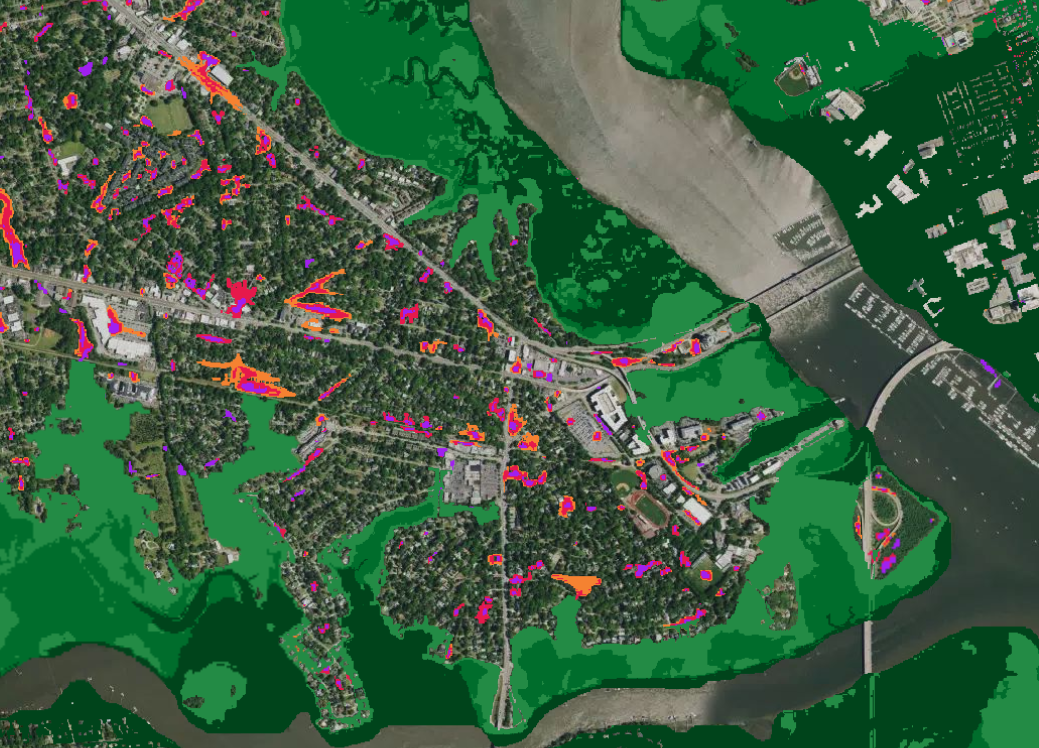

The 7Analytics Pluvial Flood Index provides a precise and actionable understanding of surface water flood exposure. It measures the inherent susceptibility of an area to surface water flooding, independent of any historical or simulated rainfall event. It reflects topography, drainage patterns, soil permeability, and land use, providing a stable, static indicator of pluvial vulnerability. This layer is ideal for portfolio screening, risk selection, and pricing support where probabilistic data may not be available.

Unlike traditional flood models that mainly focus on rivers or coastal events, this index captures the impact of intense rainfall and flash flooding—risks that are increasing with climate change and rapid urbanization.

The key challenge with current CAT models is that pluvial flood risk is systematically underestimated, especially in urban areas. At the same time, pluvial flood risk for some buildings can be drastically overestimated in areas which have historically experienced frequent flood events.

Why do we need a new approach to flood risk modelling?

Simply put: the past is not the same as the future—and climate change is accelerating the gap.

In practical terms, 7Analytics addresses this challenge through a set of techniques:

- Climate-agnostic modelling approach – our model is intentionally decoupled from expected weather patterns, ensuring flexibility and future relevance, despite changing precipitation patterns.

- Distinct treatment of vulnerability vs. forecasting – understanding physical vulnerability and predicting weather are two different tasks, which we keep clearly apart.

- Layered weather and climate integration – weather and climate models can be applied on top of the physical risk analysis to reflect different scenarios.

- Urbanization intelligence – unique capabilities in producing and utilizing high-quality data on how urbanization changes terrain and land-use cover.

By combining high-resolution hydrological modelling with this innovative framework, we deliver a street- and property-level view of pluvial flood risk. The dimensionless index score (0 to 1) translates complex hazard simulations into an intuitive metric that supports insurers, asset managers, and municipalities in forming an enhanced view of pluvial risk and taking more informed decisions on how to treat pluvial risk.