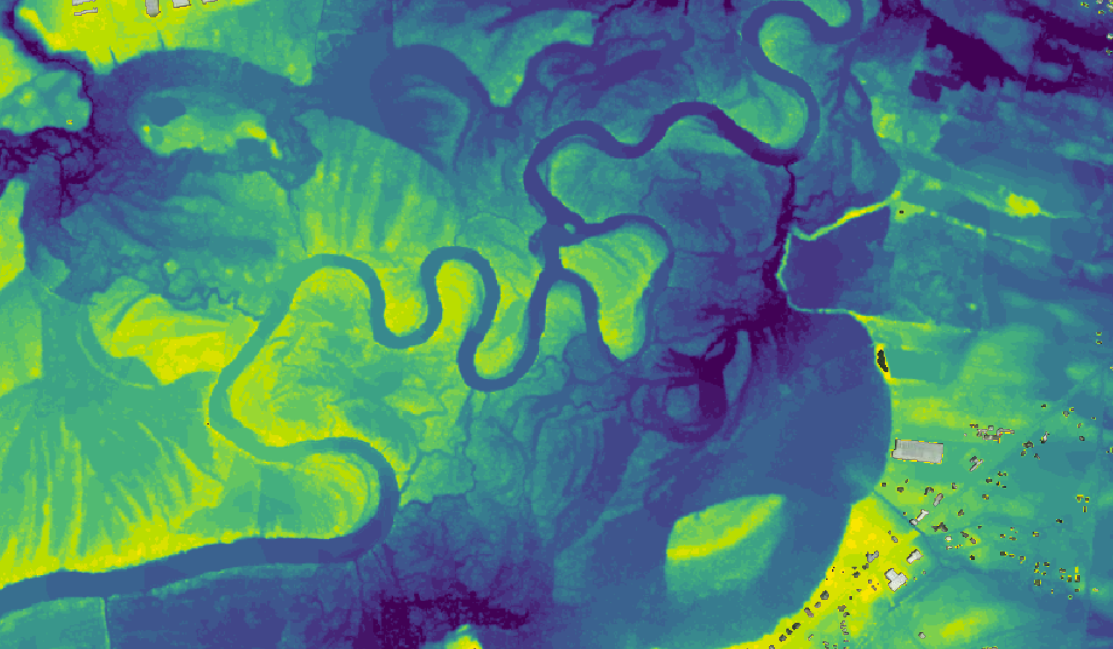

Utilizing flood risk data from 7Analytics, The Central Bank of Norway addresses the consequences of physical climate risk for homeowners, insurers and banks in their new Financial Stability Report 2025 H2: Vulnerability and risk in households and enterprises.

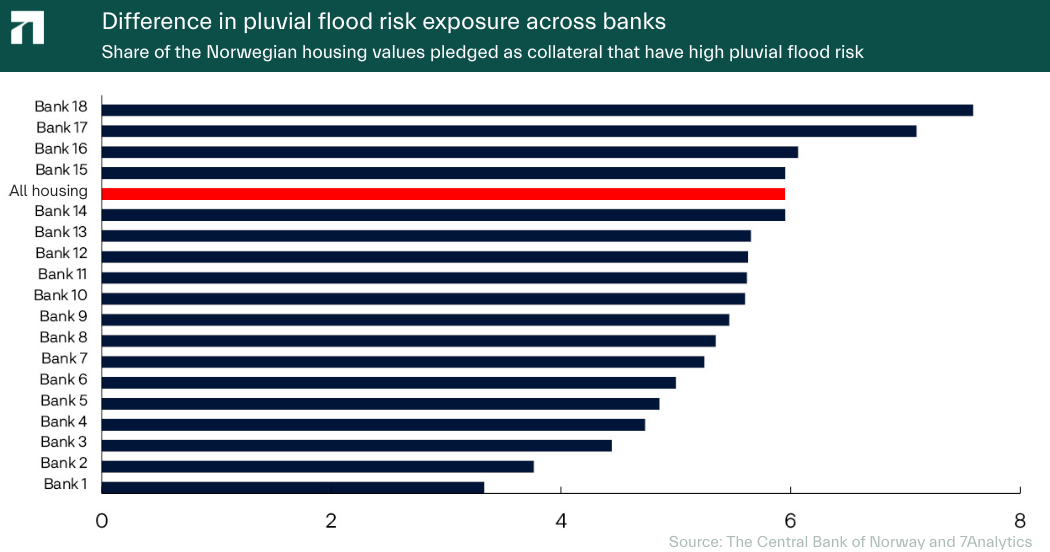

Stormwater-related damages have already pushed home-insurance prices and municipal utility fees above CPI growth. For banks and financial stability, this means higher premiums, higher deductibles and stricter terms — and, in the long run, the risk of lower property values and negative pressures on local economic activity and wage development.

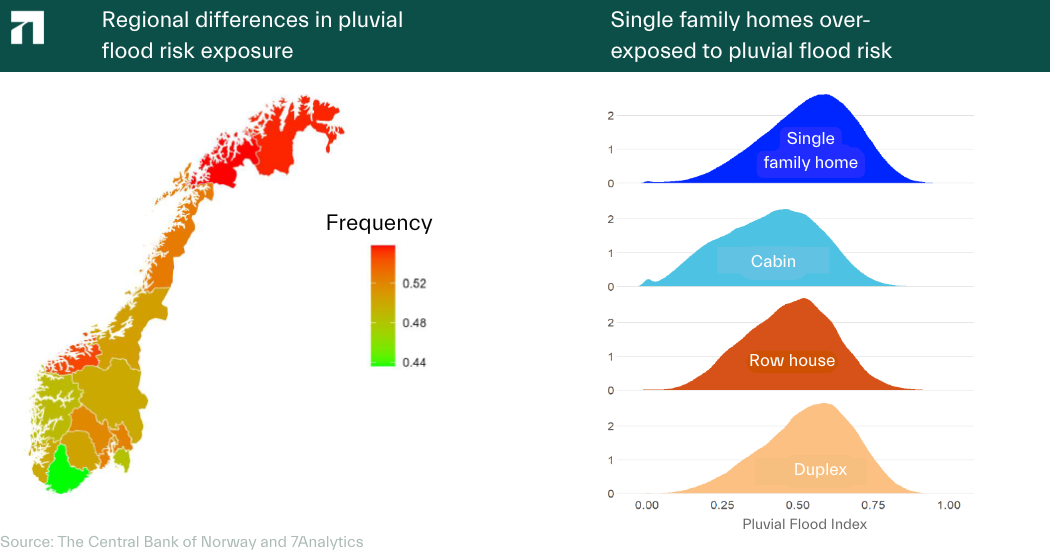

For pluvial flood risk, there are clear and systematic differences across housing types. Detached houses and small homes face higher exposure, and the share of high-risk buildings is larger in the two regions of Northern Norway and the North-West.

Banks also differ in how much of their mortgage portfolios are tied to these higher-risk properties.

The Central Bank of Norway emphasizes that effective risk management depends on high-quality mapping of risk factors — and points to 7Analytics as provider of such data.

This type of insight can support clearer insurance terms, more accurate premium differentiation, and more targeted preventive measures.

The report underlines the need for active decisions as the consequences of pluvial flooding continue to grow.

To read the full report (in Norwegian) see here.