From static risk data to active loss prevention

What is different about our approach?

Early warning

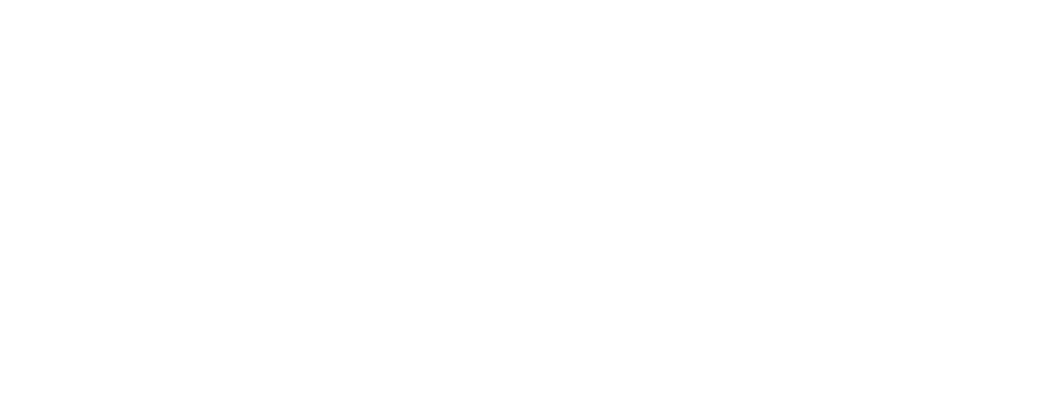

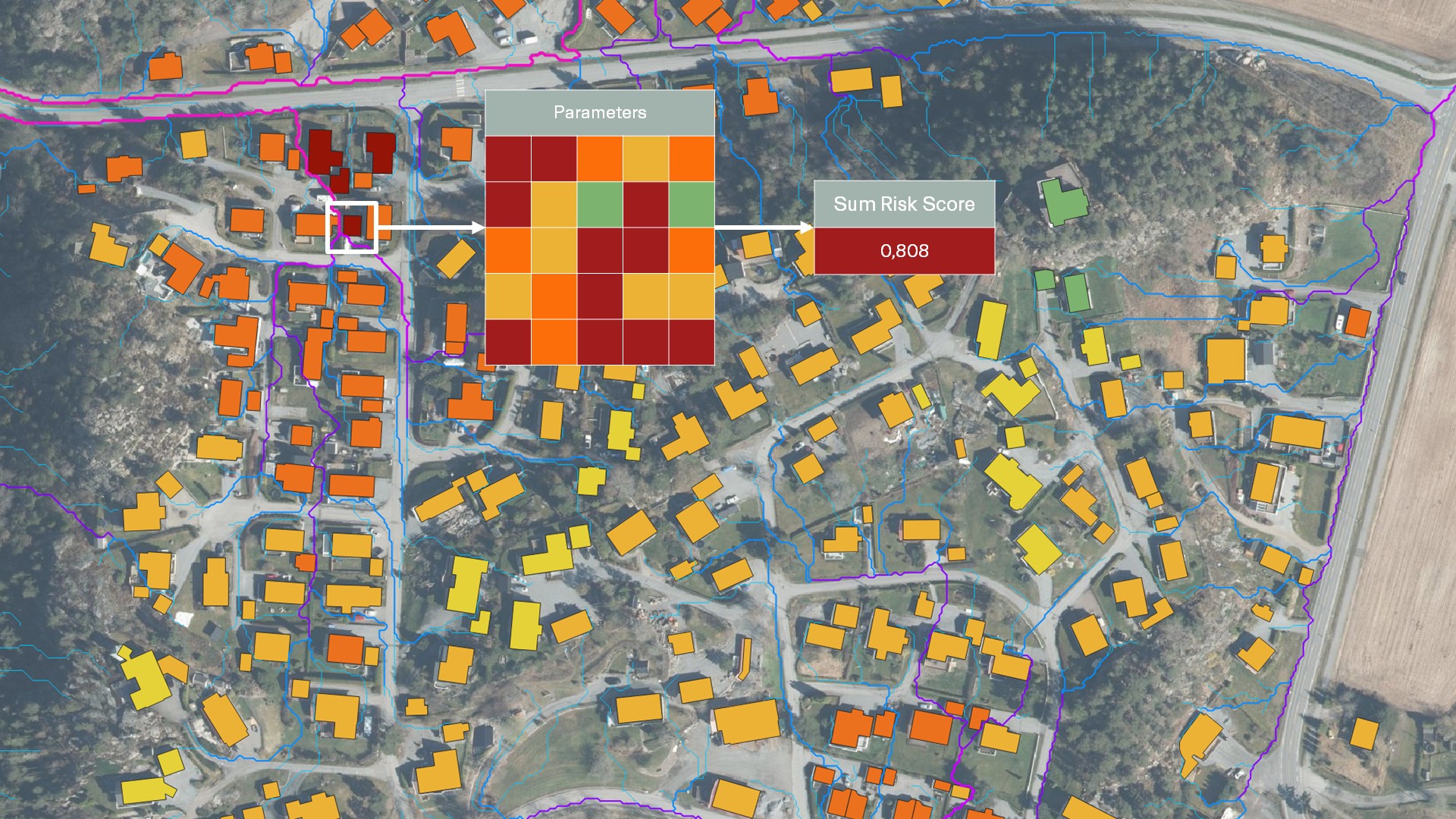

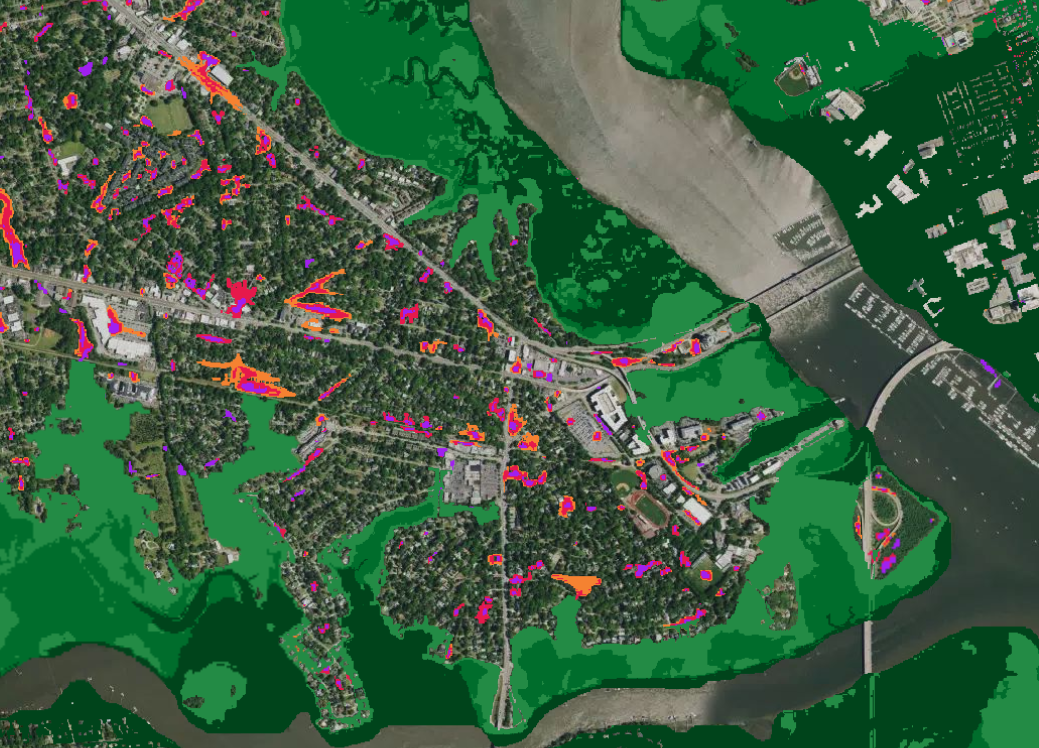

Granular resolution

Ultra high resolution of 1 x 1 m

72-hour outlook

Pluvial, flash and river floods and storm surge

Floods drive losses

Flooding is the fastest-growing driver of property losses. Most claims come from surface water after heavy rainfall in areas well beyond official flood zones. Prevention is the new frontier: insurers that can warn, incentivize, and act early will cut losses and keep premiums affordable.

What’s cutting-edge today?

- Parametric triggers & resilience credits: Carriers in the UK and US already reward customers who install sensors, drainage upgrades, or deployable barriers with premium discounts and near-instant parametric payouts.

- Real-time forecasting networks: Dense IoT rain and level sensors combined with short-range radar give neighbourhood-scale alerts hours in advance, allowing emergency measures before damage occurs.

- Resilience investment programs: Initiatives that fund resilient rebuilds— moving assets to higher ground, adding green infrastructure—turn claims into long-term risk reduction.

How 7Analytics adds the missing layer

7Analytics delivers hyper-local (1 × 1 m) flood models for all flood types updated continuously and paired with 72-hours ahead forecasts on a rolling window with depth predictions for every hour. That precision lets insurers move from static risk data to active loss prevention:

- Actionable early warning – Push site-specific alerts to policyholders, municipalities, and commercial clients with enough lead time to deploy barriers or relocate assets.

- Data-driven incentives – Use our risk deltas to offer premium discounts or resilience credits only where they measurably cut expected losses, reducing basis risk in incentive programs.

- Capital efficiency – Lower expected-loss volatility supports cheaper reinsurance and smaller capital buffers.

By combining forecasting accuracy with underwriting intelligence, 7Analytics turns flood insurance from a reactive payout into a proactive protection service—helping carriers and their customers stay ahead of the next storm, not just pay for it afterward.