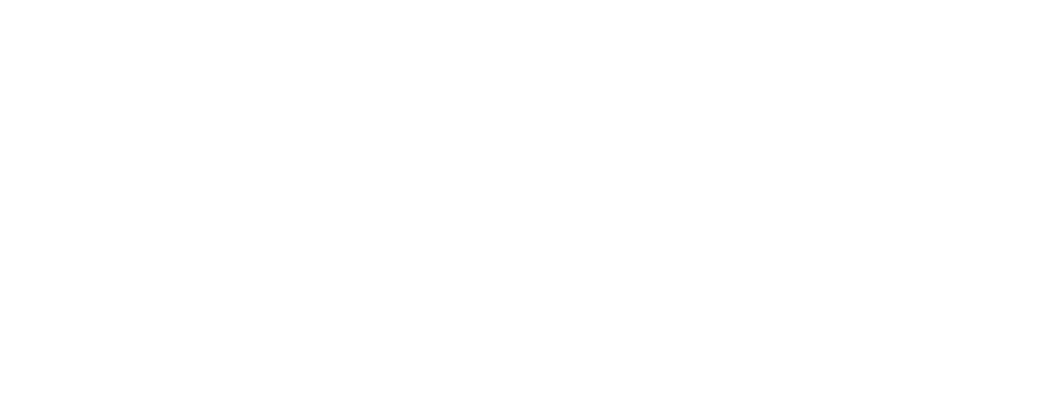

1 x 1 m geospatial resolution land-use cover and terrain data

What is different about our approach?

Resolution

Input data update

Continuous reprocessing of new data

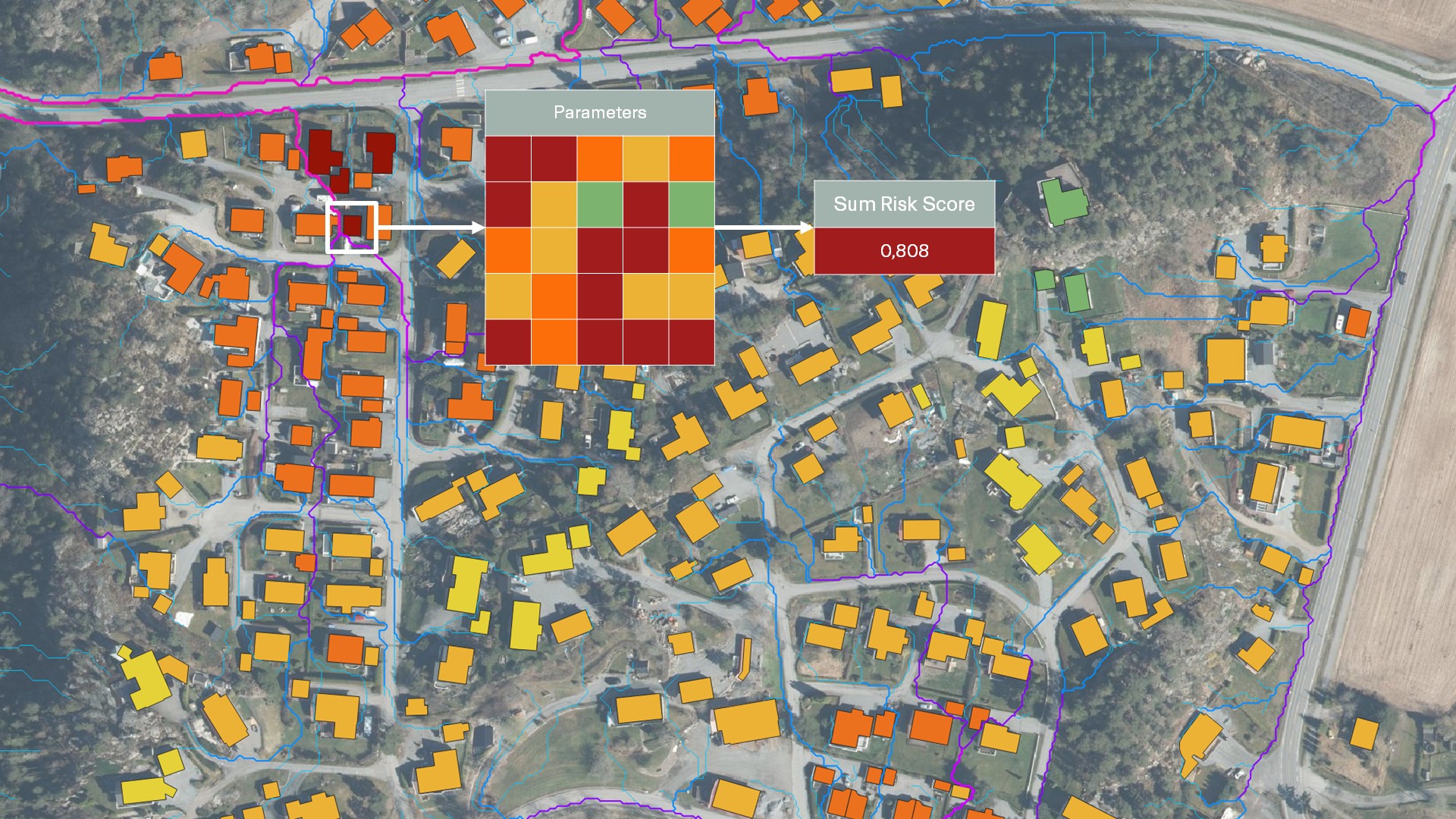

Claims training

Trained and calibrated on verified insurance claims

How granular flood risk data impacts profitability of insurance companies

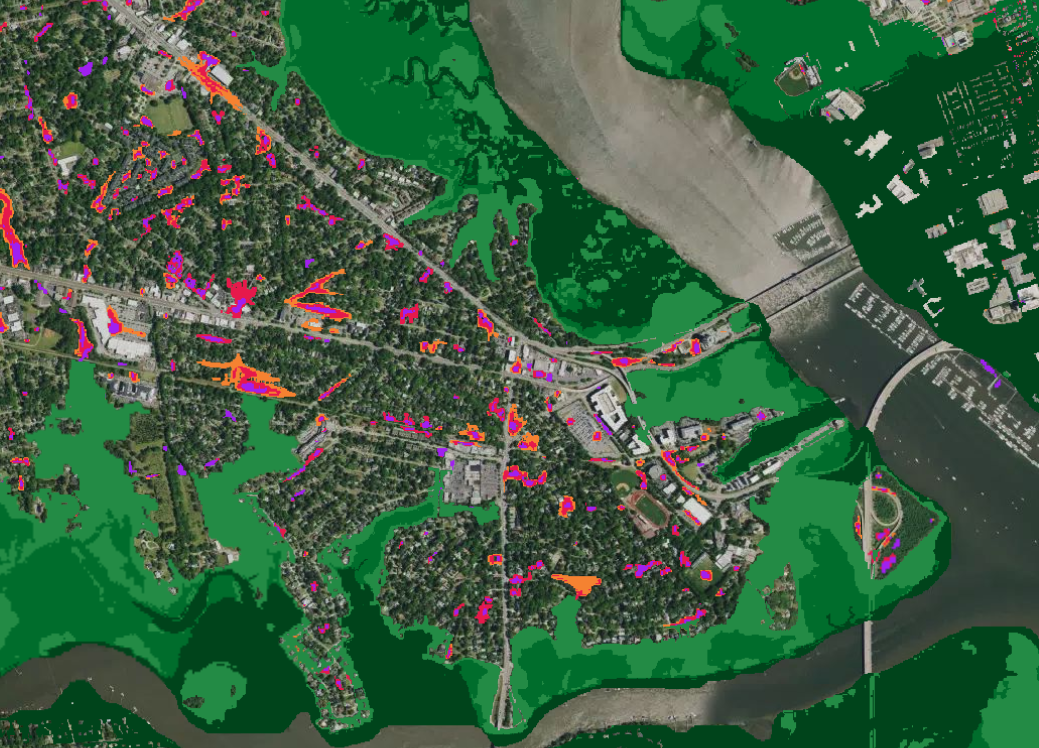

Flood risk can vary dramatically, even between neighboring properties. Capturing these differences requires the right combination of high-quality data, robust modeling, and flood-specific insight.

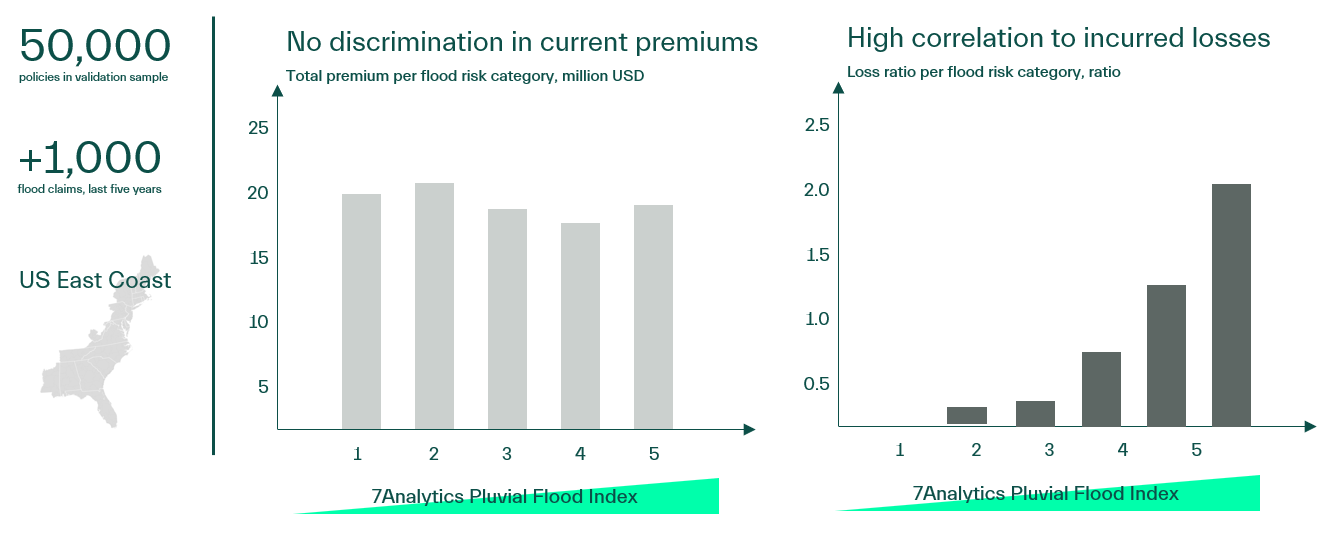

To understand how data quality influences profitability, one of our insurance partners tested 7Analytics’ model on 50,000 properties across two states on the US East Coast.

- Step one: When comparing the Pluvial Flood Risk Index, there was no discrimination in their as-is premiums. In other words: Pricing was the same across flood risk categories. This was despite pricing had taken traditional flood model insights in to account.

- Step two: Next phase in the validation was to match with historic claims. Here, there was a sharp correlation with 7Analytics’ flood risk categorization. Loss-ratios were multiples higher in higher risk categories (see illustration).

The exercise was eye-opening to the insurer. Based on the novel data, they gained a strong basis for re-pricing and portfolio rebalancing.

After having applied our models across four continents and numerous of insurers, claims patterns have emerged. These patterns can inform existing price and risk models at very detailed levels to ensure insurance profitability even in a risky climate.

> Illustration: Proof-of-Concept Results paving the way for risk-reflective pricing and improved profitability <

How to test the data

We make it easy to validate the value and accuracy of our pluvial flood index — with minimal effort from your internal team. With just a few steps, you can get high-resolution flood risk insights tailored to your locations.

Step-by-step process

- Select your area of choice:

Choose any city or region — from 1,000 to 100,000 buildings. - Send your locations

Share building addresses or coordinates with us securely. - We score the buildings

7Analytics assigns flood risk scores to each property based on our 1×1 m pluvial flood model. - We share the results

Receive detailed insights for comparison with your historical data (e.g. 3–5 years of claims). - Joint results workshop

Together, we review findings, identify patterns, and discuss how to integrate results into your workflows.

Two options to run the pilot

- Option 1: Validate the model using your location-specific claims data.

- Option 2: Compare our pluvial flood index with your existing flood models and jointly explore properties with large discrepancies